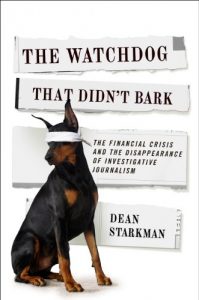

In this sweeping, incisive study, Dean Starkman exposes the critical shortcomings that softened coverage during the mortgage era and the years leading up to the financial collapse of 2008. Dividing journalism into two competing approaches—access reporting and accountability reporting—he connects the financial collapse to what happens when the former overwhelms the latter and reporters lose sight of their public role.

Starkman travels back to the early twentieth century and juxtaposes the work of reporters against other forms of journalism, particularly muckraking. These two genres merged when mainstream American news organizations institutionalized muckraking in the 1960s and created a powerful watchdog for the public interest. For many reasons, access journalism came to dominate business reporting in the 1990s, a process Starkman calls “CNBCization,” and rather than examine risky, even frankly corrupt corporate behavior, mainstream reporters focused instead on profiling executives and informing investors. This is why mostly outside reporters picked up on the brewing mortgage crisis while insiders failed to connect the dots. Starkman concludes with a critique of digital-news ideology and corporate influence, which threatens to further undermine investigative reporting, and shows how financial coverage, and journalism as a whole, can reclaim its bite.

Starkman travels back to the early twentieth century and juxtaposes the work of reporters against other forms of journalism, particularly muckraking. These two genres merged when mainstream American news organizations institutionalized muckraking in the 1960s and created a powerful watchdog for the public interest. For many reasons, access journalism came to dominate business reporting in the 1990s, a process Starkman calls “CNBCization,” and rather than examine risky, even frankly corrupt corporate behavior, mainstream reporters focused instead on profiling executives and informing investors. This is why mostly outside reporters picked up on the brewing mortgage crisis while insiders failed to connect the dots. Starkman concludes with a critique of digital-news ideology and corporate influence, which threatens to further undermine investigative reporting, and shows how financial coverage, and journalism as a whole, can reclaim its bite.